Unlocking the Power of Harmonic Patterns in Trading

Harmonic Patterns in Trading

What are Harmonic Patterns?

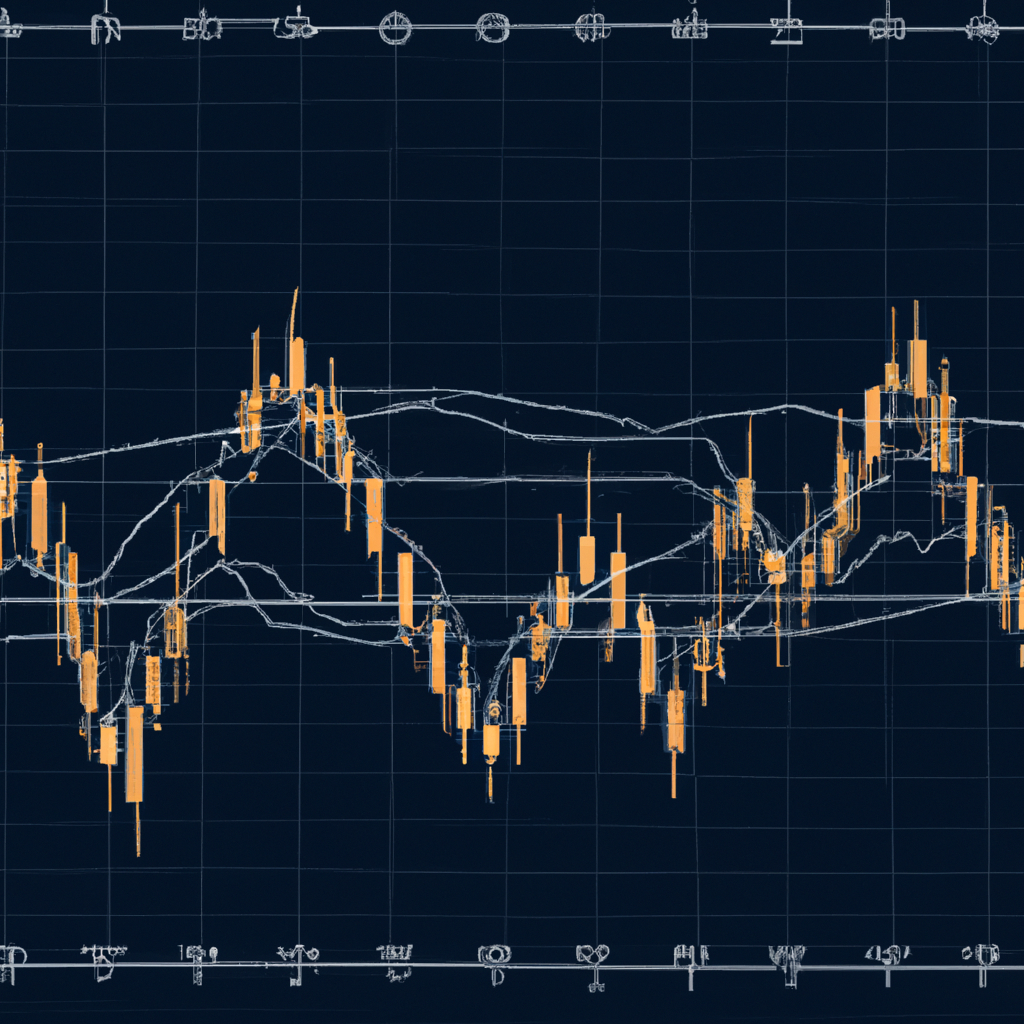

Harmonic patterns are a type of technical analysis used by traders to predict potential price movements in the financial markets. These patterns are based on Fibonacci ratios and geometric shapes that repeat themselves in the market.

Types of Harmonic Patterns

1. Gartley Pattern

The Gartley pattern is one of the most common harmonic patterns and is identified by specific price levels that form a “M” or “W” shape on the chart. Traders use this pattern to predict potential reversals in the market.

2. Butterfly Pattern

The butterfly pattern is another popular harmonic pattern that resembles the wings of a butterfly. This pattern is used to identify potential trend reversals in the market.

3. Bat Pattern

The bat pattern is a harmonic pattern that looks like a bat’s wings and is used to predict potential trend reversals in the market. Traders use this pattern to identify entry and exit points for their trades.

How to Trade Harmonic Patterns

1. Identify the Pattern

The first step in trading harmonic patterns is to identify the pattern on the chart. Traders can use tools like Fibonacci retracement levels and geometric shapes to identify these patterns.

2. Confirm the Pattern

Once the pattern is identified, traders should confirm it with other technical indicators like moving averages, RSI, or MACD. This helps to validate the pattern and increase the likelihood of a successful trade.

3. Set Stop Loss and Take Profit Levels

It is important to set stop loss and take profit levels when trading harmonic patterns to manage risk and protect profits. Traders should place their stop loss below or above the pattern and set a target price based on Fibonacci extensions.

4. Monitor the Trade

After entering a trade based on a harmonic pattern, traders should monitor the trade closely and adjust their stop loss and take profit levels as needed. It is important to stay disciplined and stick to the trading plan.

Conclusion

Harmonic patterns are a powerful tool for traders to predict potential price movements in the financial markets. By understanding and trading these patterns effectively, traders can improve their trading strategies and increase their chances of success.