Mastering Time-series Analysis for Successful Trading

Time-series Analysis in Trading

Introduction

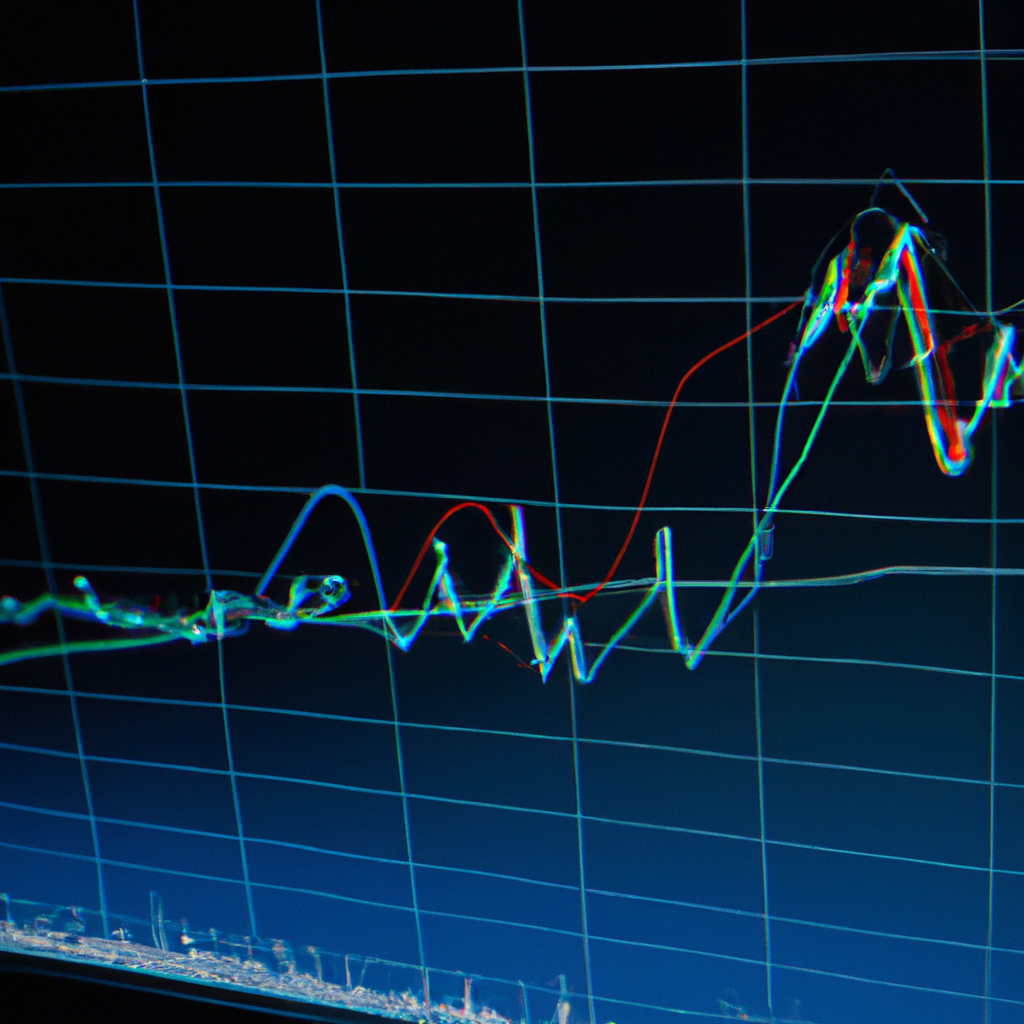

Time-series analysis is a crucial tool in trading that helps investors make informed decisions based on historical data. By analyzing past price movements and trends, traders can predict future market behavior and identify potential opportunities for profit.

Types of Time-series Analysis

Technical Analysis

Technical analysis involves studying historical price charts and using various indicators to predict future price movements. Traders use tools such as moving averages, relative strength index (RSI), and Bollinger Bands to identify trends and make trading decisions.

Fundamental Analysis

Fundamental analysis focuses on evaluating the financial health and performance of a company to determine its intrinsic value. Traders analyze factors such as earnings reports, economic indicators, and industry trends to make investment decisions.

Steps in Time-series Analysis

Collecting Data

The first step in time-series analysis is collecting historical data on the asset or market you are interested in trading. This data can be obtained from financial websites, trading platforms, or data providers.

Data Preprocessing

Before conducting analysis, it is essential to clean and preprocess the data to remove any outliers or errors. This may involve filling in missing values, normalizing the data, or removing irrelevant data points.

Choosing a Model

Traders can choose from a variety of models for time-series analysis, such as ARIMA (AutoRegressive Integrated Moving Average), GARCH (Generalized Autoregressive Conditional Heteroskedasticity), or machine learning algorithms like LSTM (Long Short-Term Memory).

Testing and Validation

Once a model is selected, traders need to test its accuracy and performance using historical data. This involves backtesting the model on past data to see how well it predicts future price movements.

Implementing the Strategy

After validating the model, traders can implement their trading strategy based on the predictions generated by the time-series analysis. This may involve setting entry and exit points, stop-loss orders, and risk management strategies.

Conclusion

Time-series analysis is a powerful tool that can help traders make informed decisions and improve their trading performance. By analyzing historical data and trends, traders can identify potential opportunities for profit and minimize risks in the market.