Exploring Harmonic Patterns: A Guide to Trading Success

Understanding Harmonic Patterns in Trading

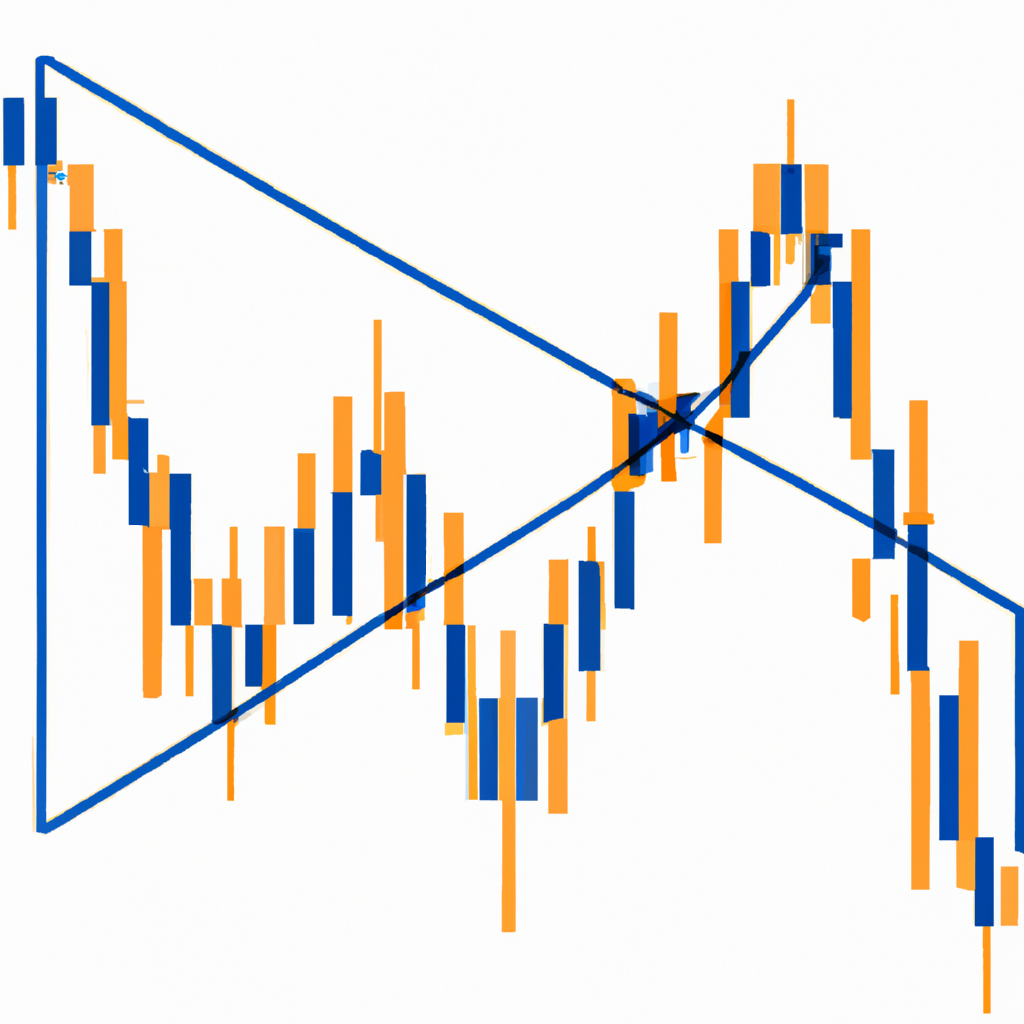

Harmonic patterns are a popular tool used by traders to identify potential reversal points in the market. These patterns are based on Fibonacci levels and geometric shapes that appear in price charts. By recognizing these patterns, traders can anticipate market movements and make more informed trading decisions.

Types of Harmonic Patterns

There are several types of harmonic patterns that traders commonly look for in the market. Some of the most well-known patterns include:

- AB=CD pattern

- Gartley pattern

- Butterfly pattern

- Crab pattern

- Bat pattern

Identifying Harmonic Patterns

Harmonic patterns are typically identified by connecting swing highs and swing lows on a price chart. Traders look for specific ratios between these points, such as 0.618, 0.786, and 1.618, which are based on Fibonacci levels. These ratios help determine the potential reversal points in the market.

Trading Harmonic Patterns

Once a harmonic pattern is identified, traders can use it to make trading decisions. For example, if a Gartley pattern is forming, a trader may look to enter a long position at the completion point of the pattern, with a stop loss placed below the recent low. Alternatively, if a Butterfly pattern is forming, a trader may look to enter a short position at the completion point of the pattern, with a stop loss placed above the recent high.

Risks of Trading Harmonic Patterns

While harmonic patterns can be a useful tool for traders, it is important to remember that no trading strategy is foolproof. Like any other trading strategy, harmonic patterns come with risks. Traders should always use proper risk management techniques, such as setting stop losses and managing position sizes, to protect their capital.

Conclusion

Harmonic patterns are a valuable tool for traders looking to identify potential reversal points in the market. By understanding and utilizing these patterns, traders can improve their trading decisions and increase their chances of success. However, it is important to remember that trading always involves risk, and proper risk management is essential when using harmonic patterns in trading.