Exploring Fibonacci Trading Strategies with Extensions

Understanding Fibonacci Trading with Extensions

Fibonacci trading is a popular technical analysis tool used by traders to identify potential support and resistance levels in the financial markets. One of the key concepts in Fibonacci trading is the use of extensions, which can help traders identify potential price targets for their trades.

What are Fibonacci Extensions?

Fibonacci extensions are levels that go beyond the standard Fibonacci retracement levels (such as 38.2%, 50%, and 61.8%) and are used to identify potential price targets for a trade. These levels are based on key Fibonacci ratios, such as 1.618, 2.618, and 4.236, which are derived from the Fibonacci sequence.

How to Use Fibonacci Extensions in Trading

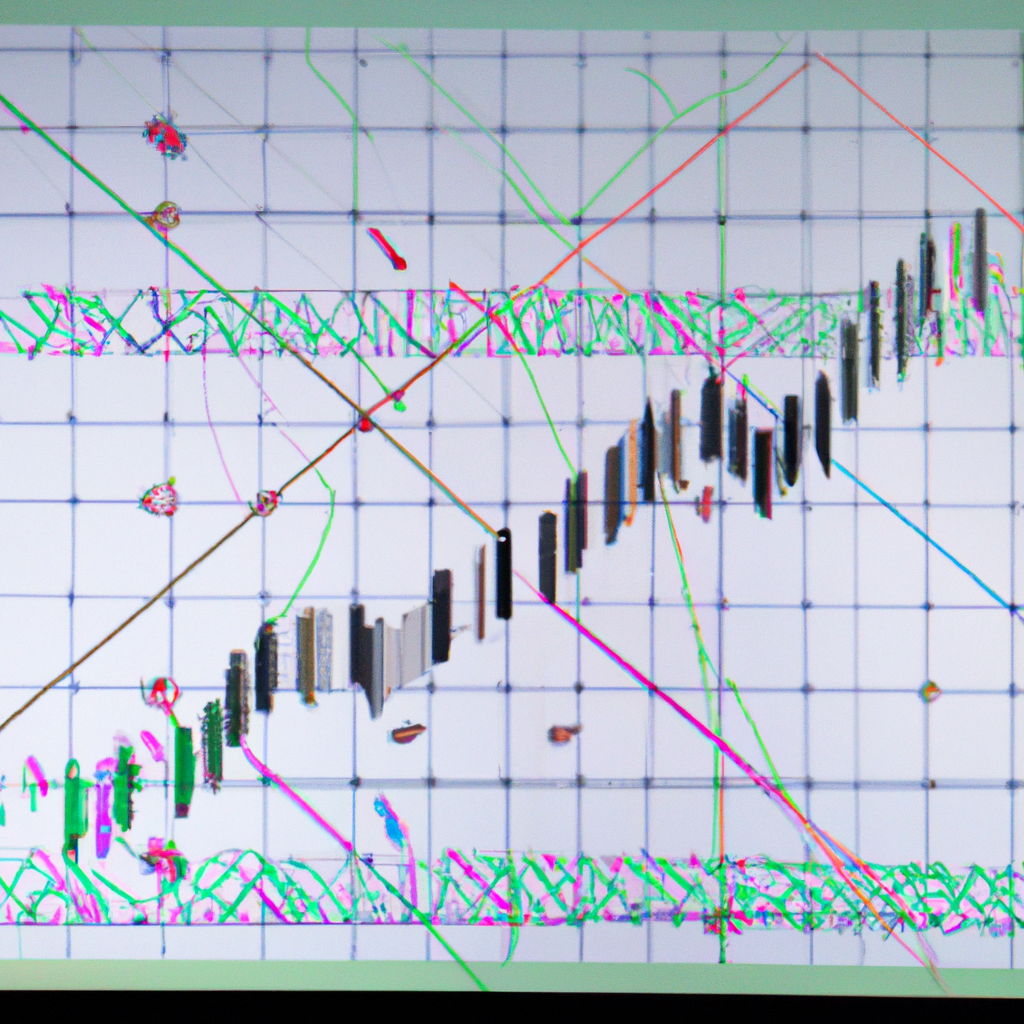

When using Fibonacci extensions in trading, traders typically look for three key points on a price chart: a swing low, a swing high, and a retracement level. Once these points are identified, traders can use Fibonacci extensions to project potential price targets for their trades.

Here are the steps to using Fibonacci extensions in trading:

Step 1: Identify the Swing Low and Swing High

Start by identifying a significant swing low and swing high on the price chart. These points will serve as the reference points for calculating Fibonacci extensions.

Step 2: Identify the Retracement Level

Next, identify a retracement level (such as 38.2%, 50%, or 61.8%) that the price has retraced to. This will help determine the potential price targets for the trade.

Step 3: Calculate Fibonacci Extensions

Using a Fibonacci extension tool, draw lines from the swing low to the swing high and then to the retracement level. The tool will automatically calculate the Fibonacci extension levels, which can be used as potential price targets for the trade.

Step 4: Set Stop Loss and Take Profit Levels

Once the Fibonacci extension levels are identified, traders can use them to set their stop loss and take profit levels for the trade. By placing stop loss orders below the swing low and take profit orders at the Fibonacci extension levels, traders can manage their risk and maximize their potential profits.

Conclusion

Fibonacci trading with extensions is a powerful tool that can help traders identify potential price targets for their trades. By following the steps outlined above and using Fibonacci extensions in conjunction with other technical analysis tools, traders can improve their trading strategies and make more informed trading decisions.