Utilizing Oscillators in Momentum Trading: A Comprehensive Guide

Momentum Trading with Oscillators

Momentum trading is a popular strategy among traders that involves buying or selling assets based on the strength of recent price movements. Oscillators are technical indicators that can help traders identify potential entry and exit points for their trades. In this article, we will explore how to use oscillators in momentum trading.

What are Oscillators?

Oscillators are technical indicators that fluctuate between a specific range, typically 0 to 100. They are used to identify overbought or oversold conditions in the market, as well as to confirm the strength of a trend. Popular oscillators include the Relative Strength Index (RSI), Stochastic Oscillator, and Moving Average Convergence Divergence (MACD).

Using Oscillators in Momentum Trading

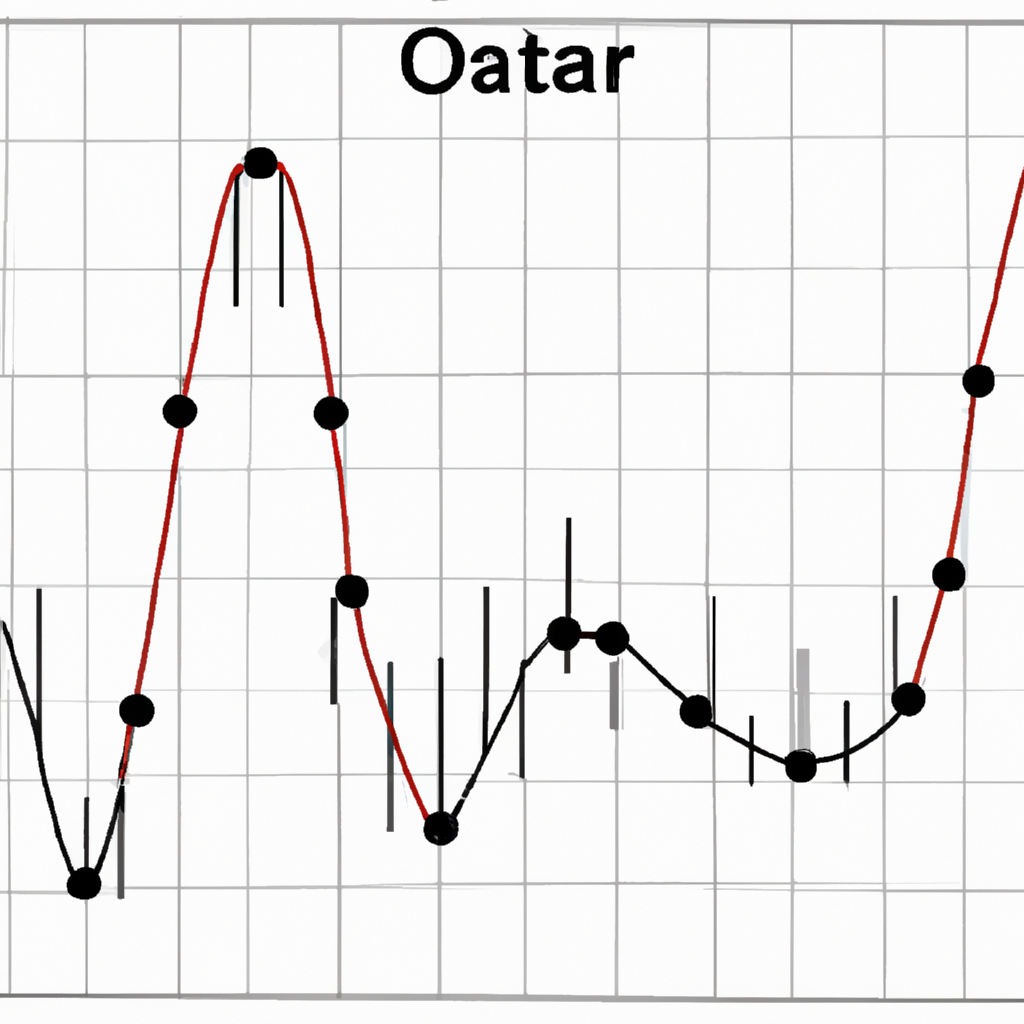

When using oscillators in momentum trading, traders typically look for divergence between the oscillator and the price of the asset. Divergence occurs when the oscillator is moving in the opposite direction of the price, indicating a potential reversal in the trend.

Steps to Use Oscillators in Momentum Trading

- Choose an oscillator to use in your analysis, such as the RSI or Stochastic Oscillator.

- Identify overbought and oversold levels on the oscillator. Overbought conditions typically occur when the oscillator is above 70, while oversold conditions occur when the oscillator is below 30.

- Look for divergence between the oscillator and the price of the asset. If the oscillator is making lower highs while the price is making higher highs, this could indicate a potential reversal in the trend.

- Use the oscillator to confirm the strength of a trend. If the oscillator is trending in the same direction as the price, this could indicate a strong trend.

- Consider using multiple oscillators for confirmation. Using multiple oscillators can help reduce false signals and increase the accuracy of your trades.

Conclusion

Oscillators are valuable tools for momentum traders looking to identify potential entry and exit points for their trades. By using oscillators to confirm the strength of a trend and identify divergence, traders can make more informed trading decisions. Remember to always use proper risk management techniques and combine oscillators with other technical indicators for a well-rounded trading strategy.