Detecting Harmonic Patterns in Trading: A Powerful Tool for Traders

Harmonic Patterns Detection

Introduction

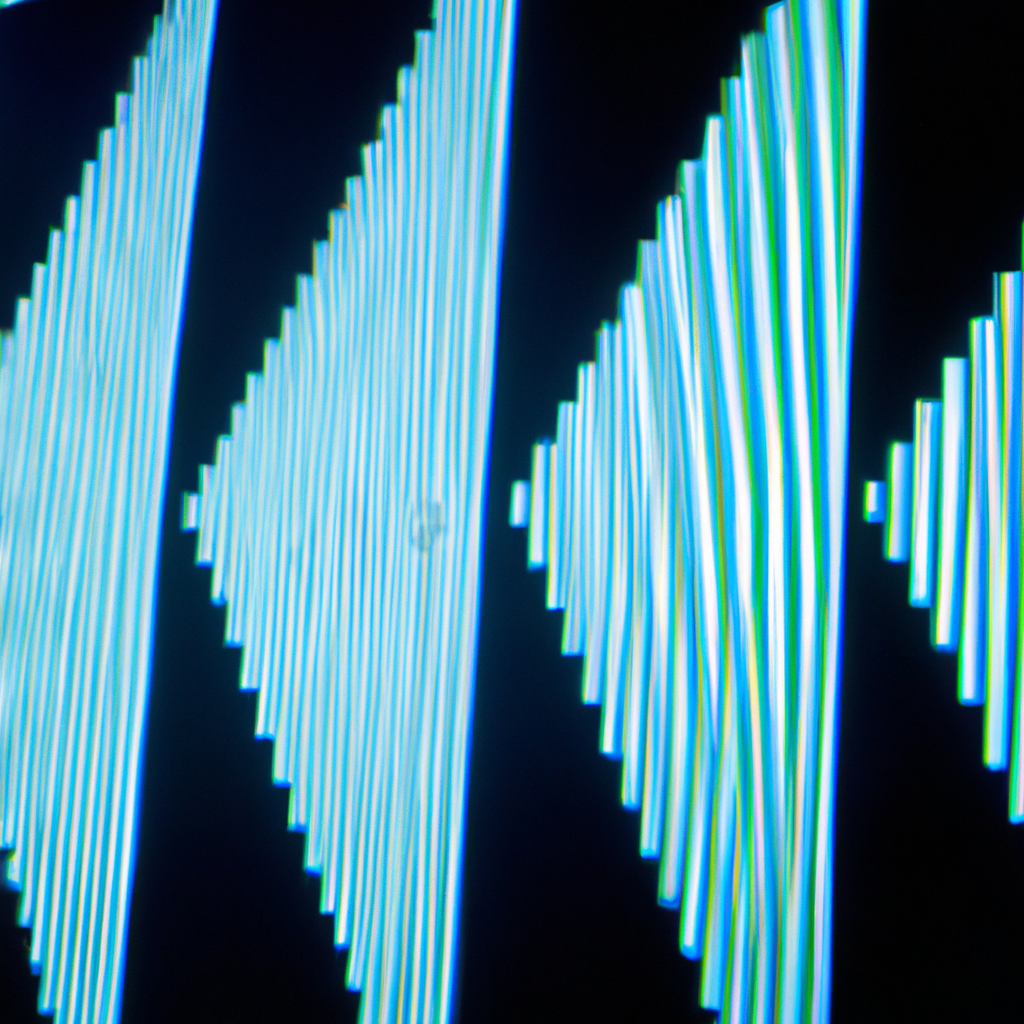

Harmonic patterns are a popular tool used by traders to identify potential reversal points in the financial markets. These patterns are based on Fibonacci ratios and are often seen as a way to predict future price movements with a high degree of accuracy.

Types of Harmonic Patterns

There are several types of harmonic patterns that traders can look for, including:

- ABCD pattern

- Gartley pattern

- Butterfly pattern

- Bat pattern

How to Detect Harmonic Patterns

Detecting harmonic patterns involves identifying specific price movements that conform to the Fibonacci ratios. Here are some steps to help you detect harmonic patterns:

- Identify the initial price movement (X to A)

- Measure the retracement from A to B, which should be at a Fibonacci ratio of either 0.382 or 0.618

- Measure the extension from B to C, which should be at a Fibonacci ratio of 1.272, 1.414, 1.618, or 2.618

- Look for the completion of the pattern at point D, which should be at a Fibonacci ratio of 0.786 of XA

Using Harmonic Patterns in Trading

Once you have identified a harmonic pattern, you can use it to make trading decisions. Traders often look for confirmation signals, such as candlestick patterns or oscillators, to confirm the validity of the pattern before entering a trade. It’s important to set stop-loss orders to manage risk and take profit targets based on the projected price movement of the pattern.

Conclusion

Harmonic patterns can be a powerful tool for traders looking to identify potential reversal points in the financial markets. By understanding how to detect and use these patterns effectively, traders can improve their trading strategies and increase their chances of success.